Payment Options/Minimum Payment

Thanks to Mangie Koza who taught me how to insert a table!

Let's return to the previous Payment Options post for a refresher:

The primary feature which makes this loan program so flexible and customized, if you will, for each borrower is the payment options. Each monthly statement will reflect four payment options:

The minimum payment (remember, you must always make at least the minimum payment),

An interest only payment,

A fully amortizing payment based on a 30-year term, and

A fully amortizing payment based on a 15-year term.

Of course, you can really pay anything greater than the minimum payment, so the borrower has a myriad of payment possibilities. However, the four shown above will be the ones reflected on the monthly mortgage payment.

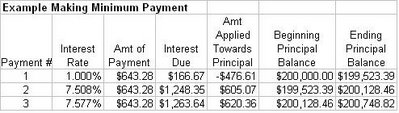

Returning to our sample loan, let's see how this works:

$200,000 loan amount

1% start rate

7.5% annual payment cap

MTA index

2.75% margin

110% neg limit

In the example shown above, the first minimum payment of $643.28, based on a 1% interest rate, was posted. $166.67 was applied to interest; $476.61 was applied to principal; the principal balance was reduced to $199,523.39

For the second payment the interest rate changed to 7.508% (index in effect at that time plus the margin). The minimum payment of $643.28 was made; however, the minimum payment was insufficient to cover even the interest-portion due on the loan. The interest due was $1,248.35. The difference the payment did not cover, $605.07, was added to the principal balance. Consequently, the principal balance increased to $200,128.46 after the second payment was applied.

For the third payment the interest rate changed to 7.577%. The minimum payment of $643.28 was made. The interest due was $1,263.64. The difference the payment did not cover, $620.36, was added to the principal balance. The principal balance increased to $200,748.22 after the third payment was applied.

This process will continue through the 12th payment. For the 13th payment, the lender will attempt to recast the loan by taking into account the principal balance at the time, the interest rate in effect at the time, amortized over the remaining term (348 months). The payment amount for the 13th payment will be increased to $691.53 (increasing by the full 7.5% payment cap).